Crypto’s Future: How Robot Trading Can Revolutionize Your Investment Strategy

While the world of cryptocurrency continues to grow and evolve, investors are looking for innovative ways to maximize their returns. A solution that has gained significant traction in recent years is to exchange robots. The cryptocurrencies on behalf of their owners, allowing them to diversify their wallets and reduce their exposure to rea.

What are trading robots?

Uses artificial intelligence techniques (ML) or artificial intelligence (AI) to Analyze Market Data and do operations. Created to Monitor Various Cryptocurrency Exchanges, Buy and Sell Coins based on default rules and adapt their strategies in real time.

How do Trading Robots Work?

Trading robots working a combination of technical analysis, fundamental analyzes and predictive models to identify testable trading opportunities. Generally follow these steps:

- Data Collection : The Bot Collects Market Data from Various Exchanges, including Prices, Volumes and Other Relevant Metics.

.

3

- Risk Management

: Some Robots use of Risks Management Strategies to lie potential losses or manage the size of the position.

Advantages of Trading Robot

Investors, including:

1.

.

*

4.

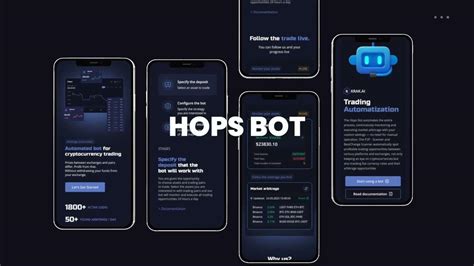

Popular Commercial Bot Platforms

Emerged, including:

.

2.

.

Challenges and Limitations

Traction in the Cryptocurrency Market, there are still several challenges and limitations to consider:

1.

.

- Safety Risks

:

Conclusion

Commercial Robots has the potential to review the way investers their investments in cryptocurrency. Wallets and Reducing Exposure to Risk, Negotiation robots can help investors to maximize their returns by minimizing their losses.